- Polkassembly/

- #2103/

Retroactive Funding for Mimir - A Powerful Multisig Management Application For Polkadot Ecosystem

Hi, dear Polkadot community:

We are the Mimir Team. Mimir won 1st in the 2023 Polkadot Asia Summer Hackathon Application Track and 2nd in the 2023 Polkadot Winter Hackathon Ecosystem Developer Tools Track.

We have received some funding support through the hackathon, but it is still insufficient to cover our current maintenance and development costs. We are proposing this treasury proposal to seek financial support for past development efforts.

Full Proposal Document: https://docs.google.com/document/d/1rR6nbYxjZxByXQqMYYBvf0DpV72ilq1q60pQTSVLiXs/edit?usp=sharing

Product Video: https://www.youtube.com/watch?v=amm_Vk0vzP4

Mimir Website: https://app.mimir.global/

TL;DR

Background

Terminology Explained: EOA, Externally Owned Account, is a standard single-signature account.

In the Ethereum ecosystem, Multisig has become a common requirement, evolving into one of the most significant applications in the realm of account abstraction. The largest Ethereum Multisig wallet, Safe, manages about 1% of all ETH assets (valued at $3 billion). Other concepts like Social Recovery and Seedless Login have also seen substantial project involvement and rule formulation.

Substrate, on the other hand, has long featured relevant functional modules such as the Multisig Pallet, Recovery, and Proxy. These can either independently provide or combine to offer powerful Account Abstraction (AA) functionalities. Furthermore, in the Polkadot network, Multisigs control 5% of all DOT assets. This demand for Multisig is five times that of Ethereum, indicating a more robust need among Polkadot ecosystem users.

However, within the current Polkadot ecosystem, non-EOA wallets face three primary challenges:

Account Creation and Management

Challenge 1: On a technical level, Polkadot provides account abstraction components like Multisig and Proxy in its code but lacks corresponding productization. For example:

Challenge 2: Polkadot supports a diverse range of account types, yet there is no product offering a unified management portal for them.

Challenge 3: Existing Polkadot Multisig products have limited support for different types of Multisig accounts, and the account hierarchy is simplistic.

Data source:

Dune Number of Nested Multisig Accounts: Dune Analysis

ETH Managed by Standard Multisig vs. Nested Multisig: Dune Analysis

Top Projects Using Nested Multisig: Dune Analysis

Application

Challenge 1: Users face complexities in assembling transactions for non-EOA-type accounts. 74% of multisig transactions are Transfers. Stakings(3%) and Governances(0.1%) only account for a small portion of Multisig operations.

Challenge 2: Non-EOA accounts in the Polkadot ecosystem cannot interact directly with applications.

Product Introduction

Mimir is an Enterprise-level Multisig in the Polkadot Ecosystem.

Account Management

Supported account types

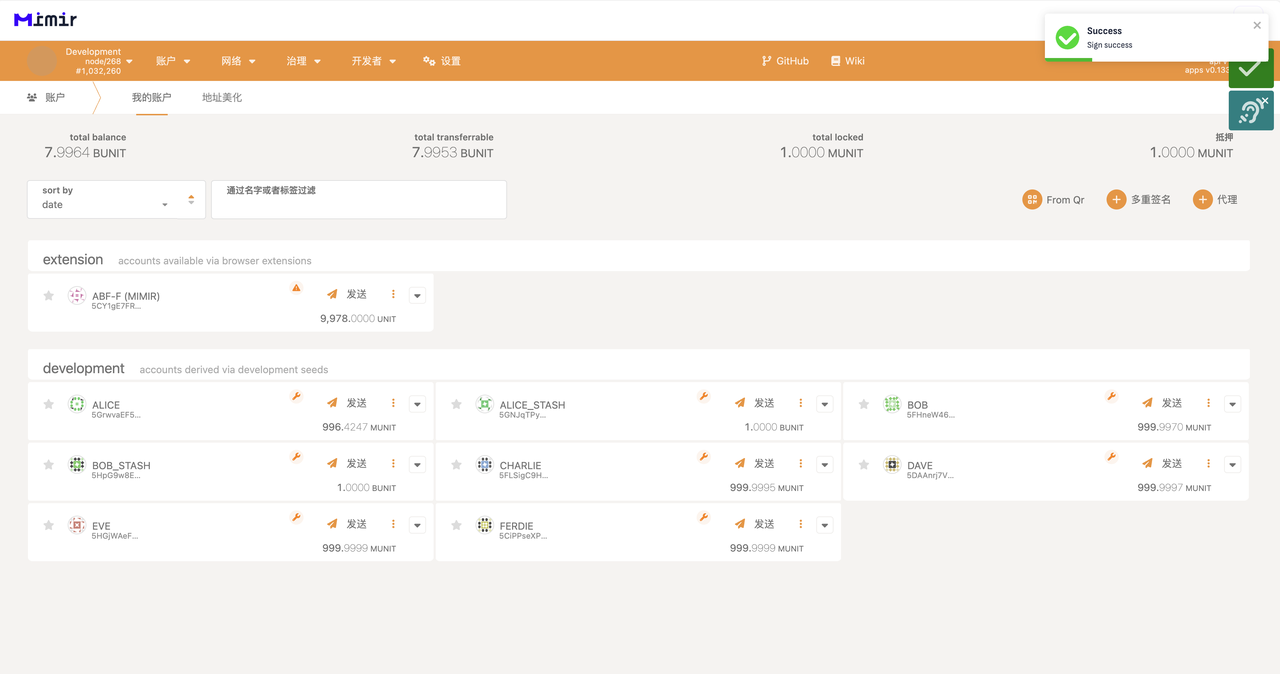

Mimir integrates various types of account systems. In the current version of Mimir, users can utilize the following types of account systems:

Extension Accounts

Multisig Accounts

Static Multisig Accounts

Flexible Multisig Accounts

| Change Member | Change Threshold | Delete Account | Different addresses with the same setting | Send transaction during the creation | |

| Flexible Multisig | √ | √ | √ | √ | √ |

| Static Multisig | × | × | × | × | × |

Advanced Accounts

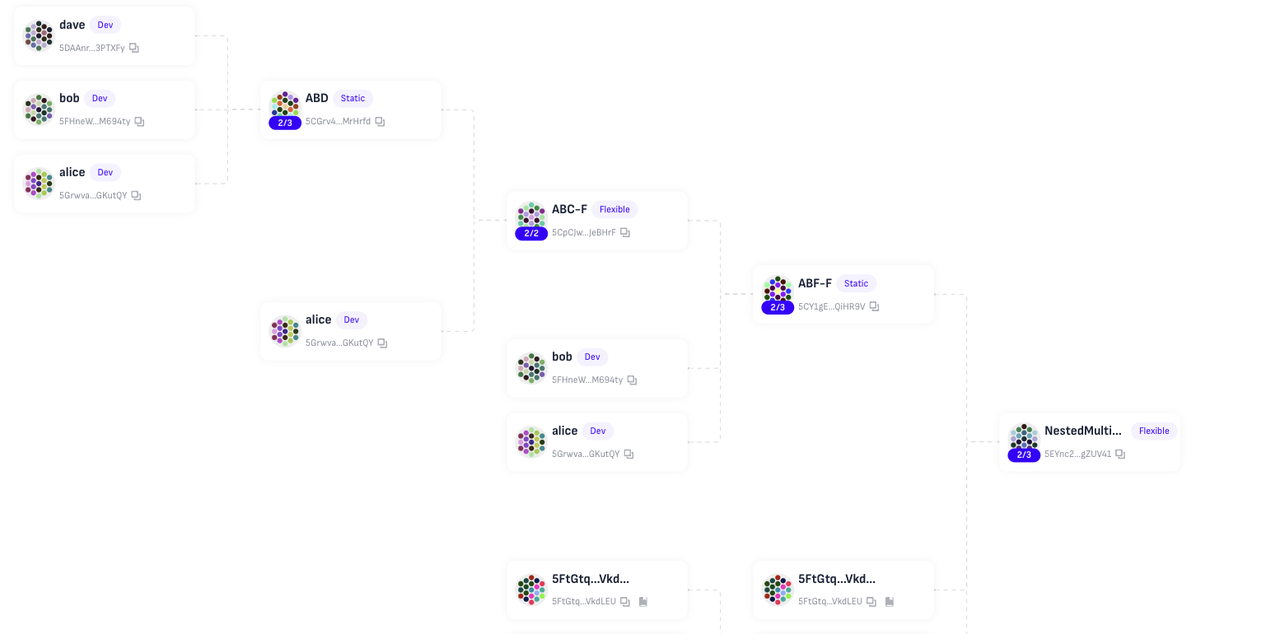

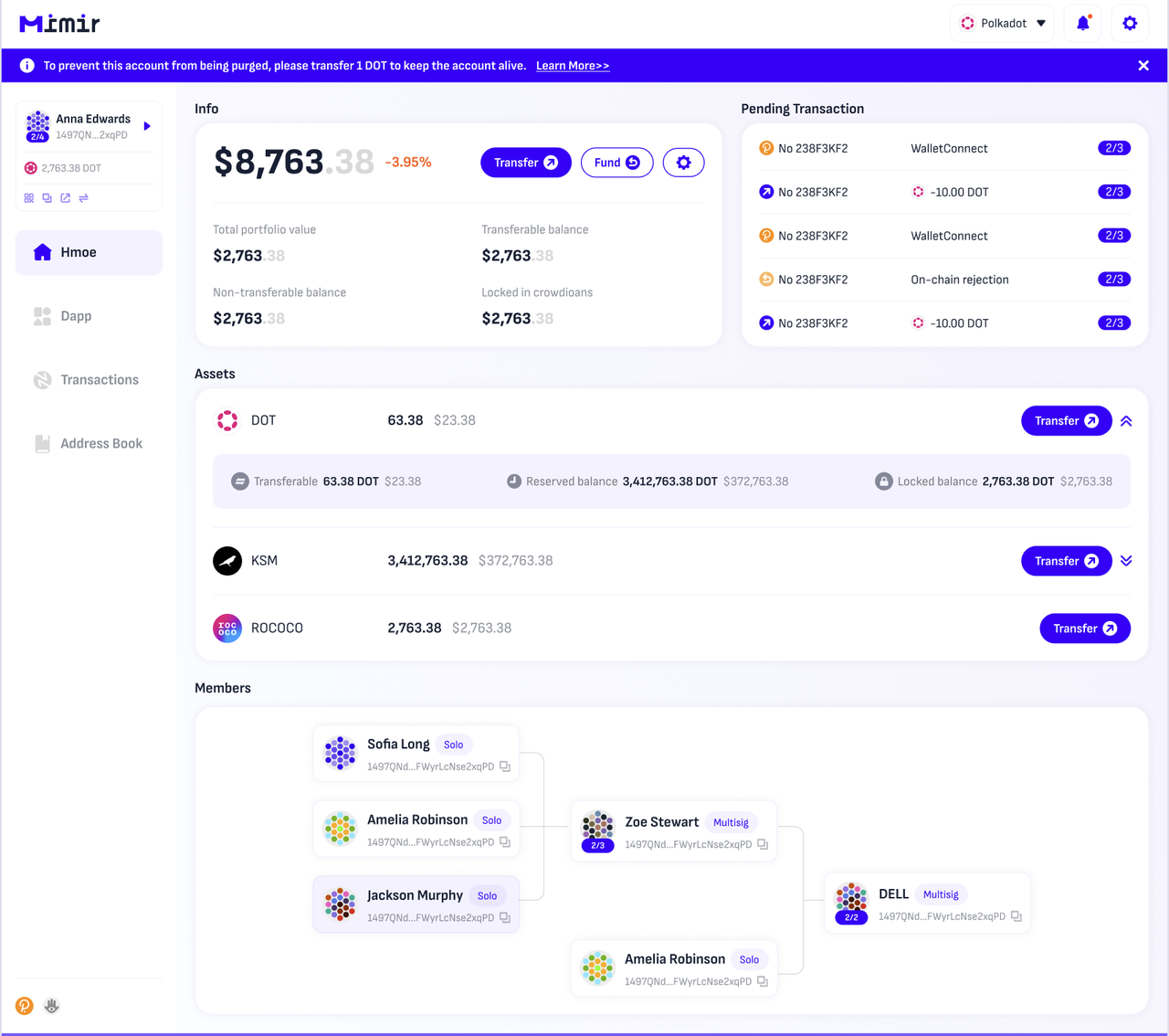

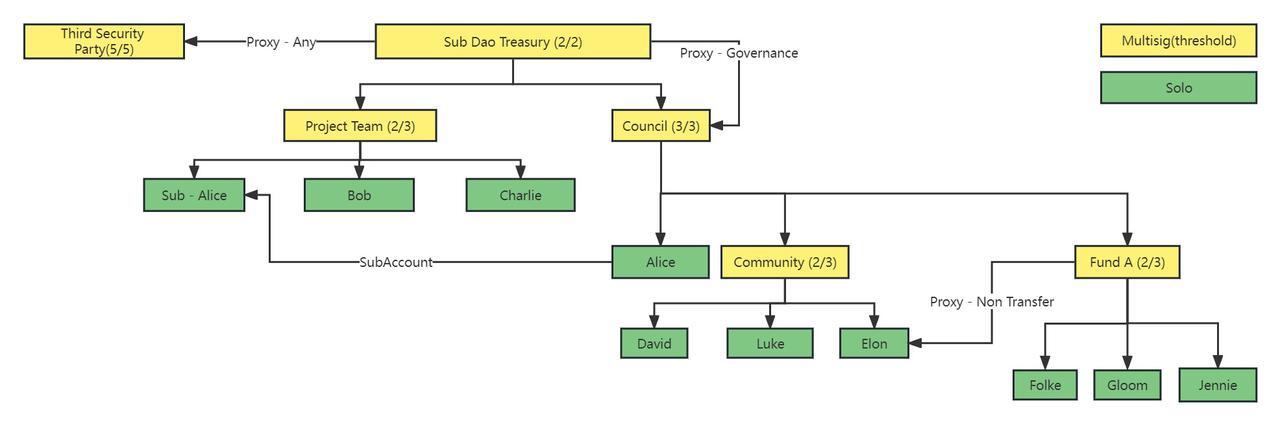

Nested Multisig Accounts

Mimir supports Nested Multisig accounts where a Multisig can include other Multisigs as its members. Users have the flexibility to choose between Flexible Multisig, Static Multisig, or EOA (Externally Owned Accounts) as members of a Multisig account.

Transaction Management

Initiate Transaction

In Mimir, users can initiate transactions for complex accounts with just a few simple clicks without the need for frequent account switching.

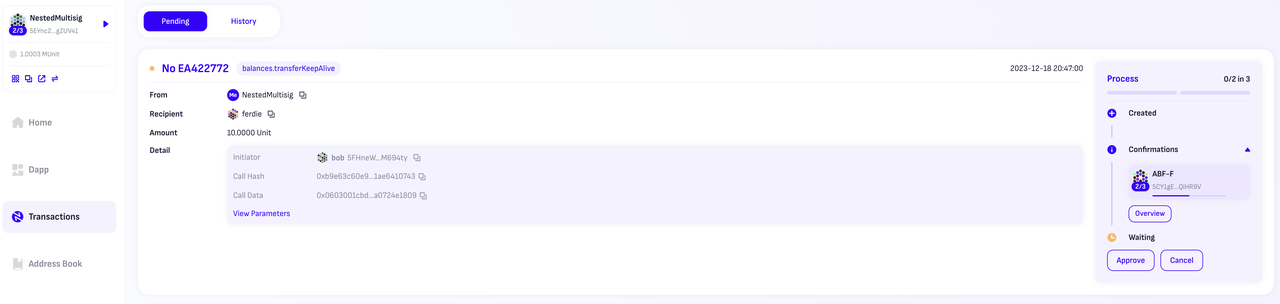

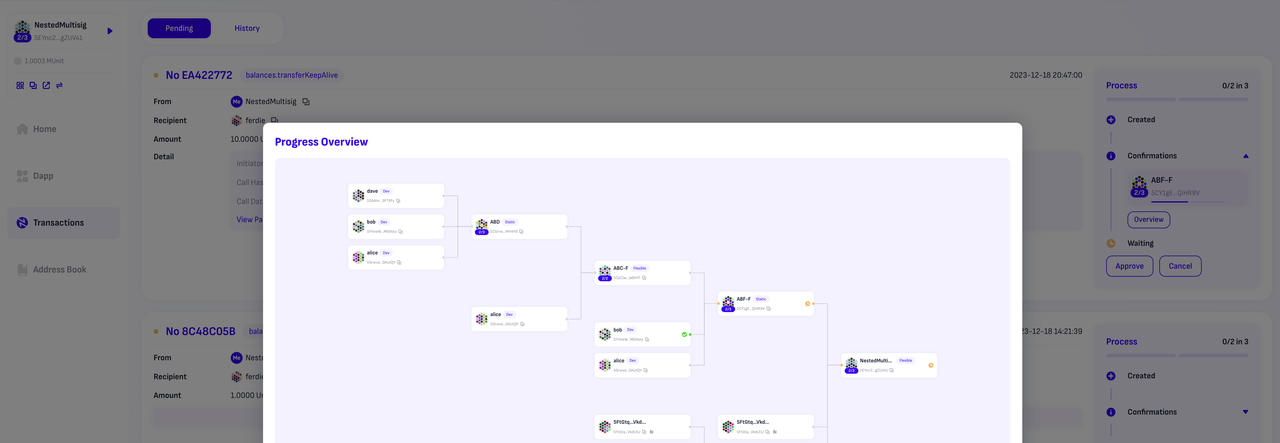

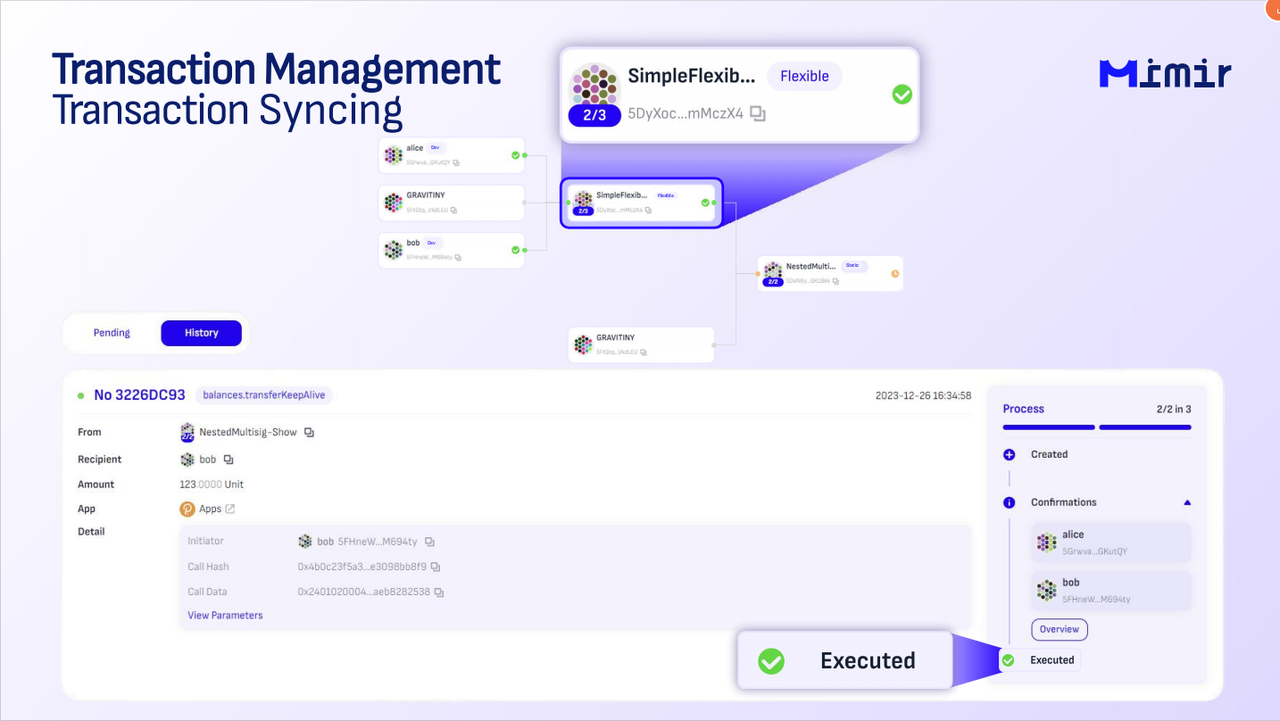

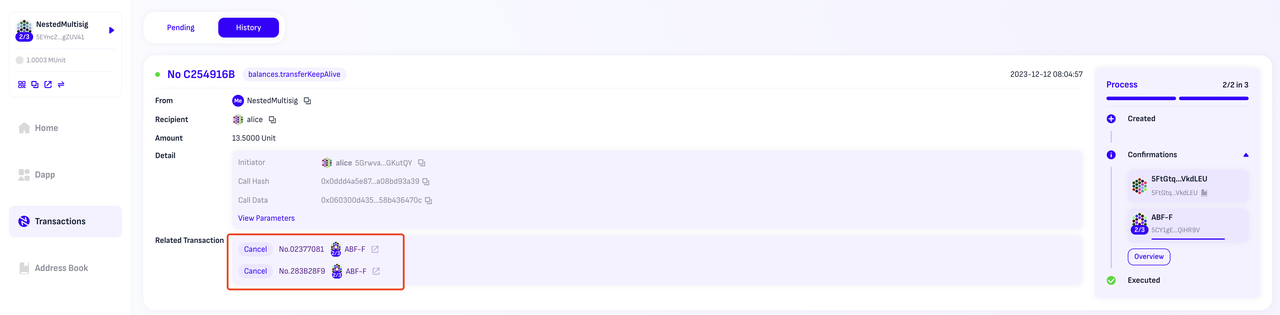

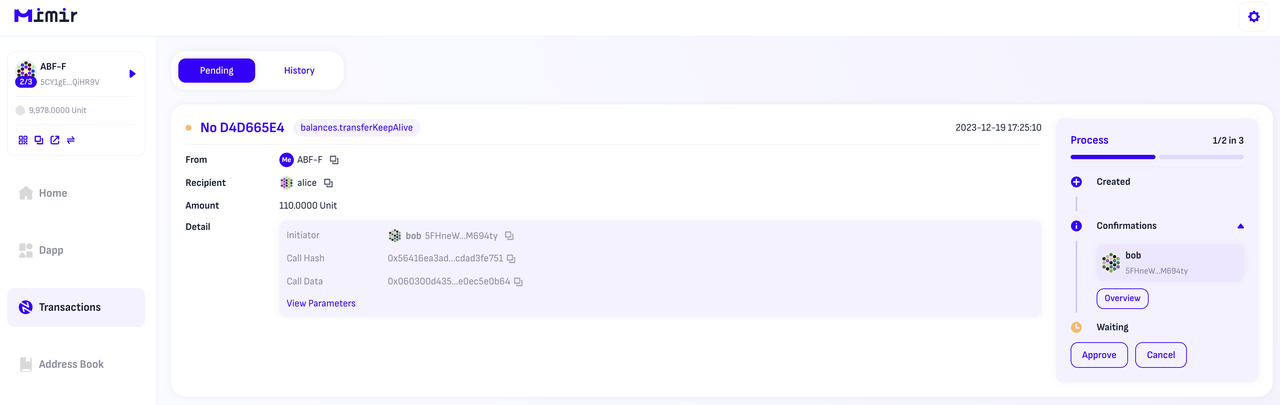

Nested Multisig Transaction Management Functions

Nested Multisig transactions increase the complexity of status tracking. For such transactions, Mimir provides the following detailed transaction management functions:

- Full Transaction Status Display

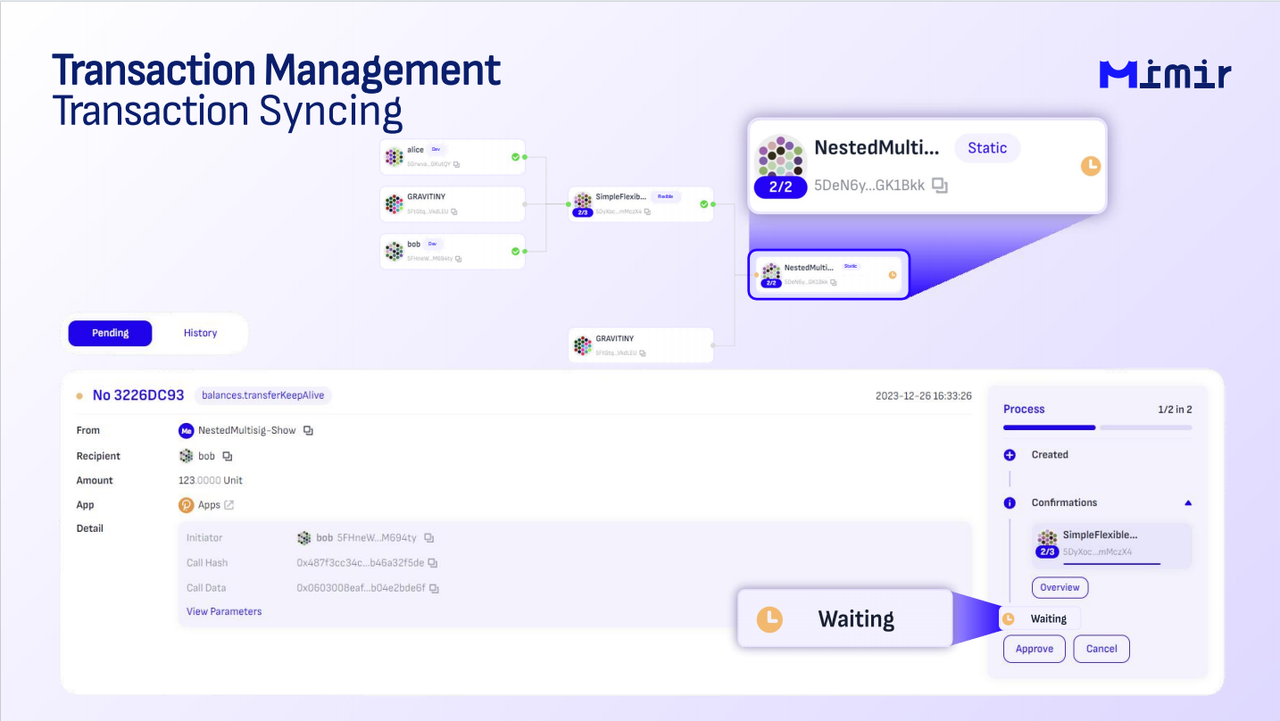

- Transaction Syncing

- Complex Transaction Cancellation

Integration with Apps

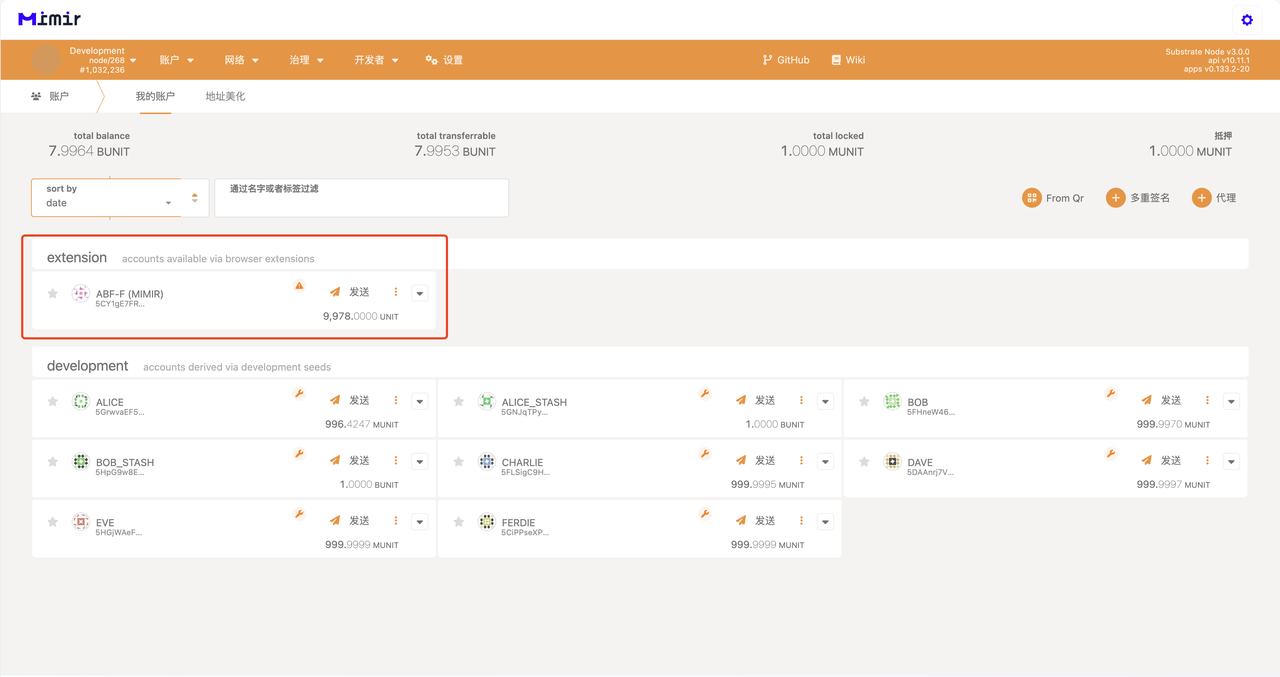

Multisig Account Injection

Currently, Mimir has begun its initial implementation with Polkadot.js as a trial. After accessing Polkadot.js via Mimir-Dapp-General, users can view all Multisig accounts created through Mimir. They can then operate applications using the identity of these Multisig accounts.

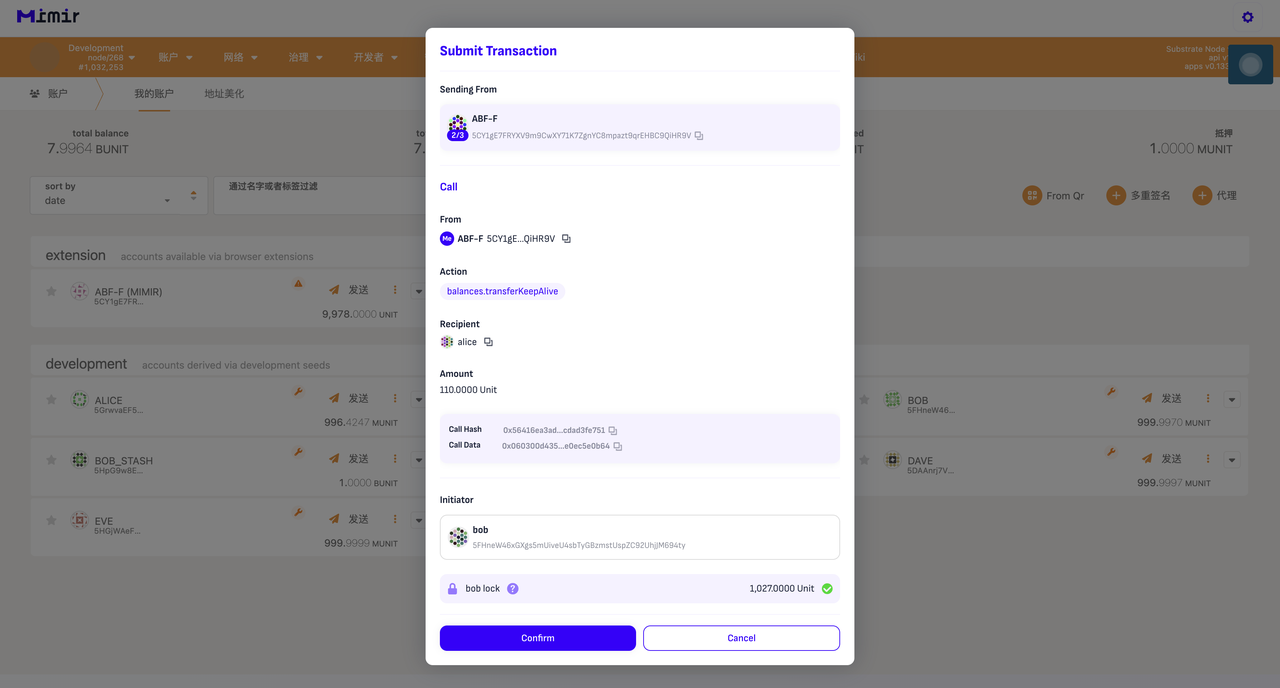

Mimir Takes Over App Transaction Assembly and Progress Tracking

Also users can track the this transaction's progress in mimir's pending transaction list:

Asset Management

Users can view the balances of various assets in the currently selected account and perform quick operations.

Ecosystem Fit

Mimir simplifies interactions with complex accounts like Multisig, Nested Multisig, and Proxy.

- Aggregate Account Management

Mimir aggregates various accounts for management: EOA/Static Multisig/Flexible Multisig/Nested Multisig.

- Versatile Transaction Assembly

Mimir offers deep support for assembling such transactions. It supports not just the assembly of Multisig transactions but also transactions involving nested Multisig levels and Proxy categories.

Making Polkadot's multisig a Safe-like solution for enterprise asset management

Support for Nested Multisig Accounts

In its initial phase, Mimir focuses on adapting to nested Multisig accounts. This greatly expands the boundaries of Multisig usage, enabling project teams to manage and allocate project funds in a decentralized manner through a nested Multisig account.

Mimir simplifies how multisig users engage in ecosystem development with their assets.

Multisig accounts in the Polkadot ecosystem hold 5% of the ecosystem's assets, yet the most common operation is still transferring funds. For these assets to participate in ecosystem development (like Governance and Staking), complex operations are required. It's challenging for them to utilize existing products like Polkassembly, Subsquare, or Polkadot Staking directly. This reduces the usage efficiency of these users' assets.

- Third-Party Application Support

Mimir will integrate with various third-party applications and parachain DApps, making it convenient for users to manage assets directly using multisig.

- In-House Application Development

Additionally, we will develop our own DApps, such as Batch function, to fill gaps in the ecosystem and further enhance user efficiency.

Budget

Working Hours and Fee

https://docs.google.com/spreadsheets/d/12n3i_Q26EobwO-xFJw5jOvhjEU5l-RHWyBZT_pnVNdo/edit#gid=0

Payment Details:

DOT Price(EMA30 on 26/01/2024): $7.127

Retroactive Total USD: $184,770

Funded by Hackathon: $30,325 (4255 DOT)

Proposal Payment (Retroactive Total USD - Funded by Hackathon): $154,445 (21,670 DOT)

Attachment

Mimir Website(Now on Rococo): https://app.mimir.global/

Twitter: https://twitter.com/Mimir_global

Telegram: https://t.me/+t7vZ1kXV5h1kNGQ9

Email: hello@mimir.global

We welcome all parachains and Dapps within the Polkadot ecosystem to connect with us. If you have any requirements, please feel free to contact us.